We are a global operator of essential infrastructure

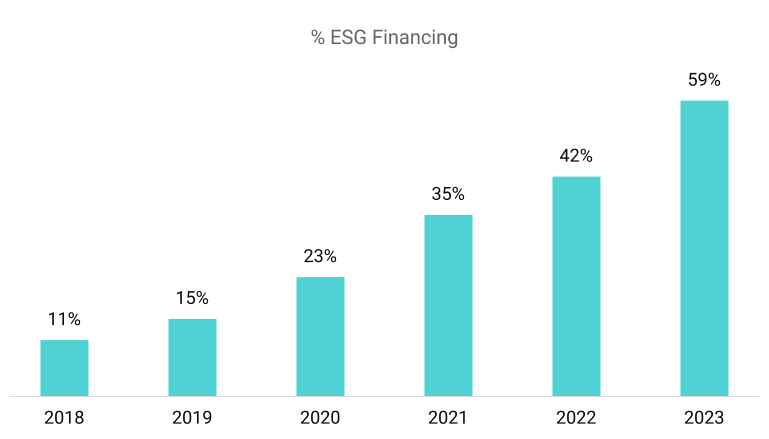

Sustainable financing

Within the framework of the “Paris Agreement” and the “UN Sustainable Development Goals (SDGs)”, specific initiatives are emerging to fight against climate change, promote sustainable development and continue to achieve improvements in the social sphere. These include actions in financial matters such as the so-called green financing, sustainable financing or ESG (ESG - Environmental, Social and Governance) financing, which incorporates various sustainability criteria regarding the access, terms & conditions and the costs of financing. A sustainable model to obtain financial resources that is increasingly widespread and in which Redeia does not want to fall behind.

In fact, Redeia aims to be an ESG-financed Company by 2030 and, in order to achieve this goal, the Company is working on two lines:

- On the one hand, through its green framework. In 2021 was accredited its alignment with the European Union Taxonomy, thus confirming the activity carried out by Red Eléctrica as TSO is sustainable.

- On the other hand, by incorporating ESG criteria into its bank financing. In 2017, the Company was the first European utility to link a syndicated credit facility to the sustainability criteria, since then, Redeia has continued to incorporate ESG criteria into financings in all its business lines (international, fibre optic, satellite).

Benefits of green financing for Redeia

1. Contribution to the Group's Sustainability Commitment

2. Alignment with the Group's strategic plan

3. Opening to new financing markets

4. Possibility of reducing the cost of financing

5. Strengthening the relationship with sustainability agencies and financial agents

6. Support in the positioning of Redeia as a sustainability leader

Benefits of green financing

Red Eléctrica´s Green Framework is aligned with the Green Principles 2021 of the “International Capital Markets Association” (ICMA) and “Loan Markets Association” (LMA), as well as with the “European Commission Taxonomy Climate Delegated Act 2021”.

With the implementation of its green financing framework, Red Eléctrica aims to:

- Align its funding strategy with its sustainability strategy and its commitment to decarbonization of the economy

- Align itself with the Spanish National Integrated Energy and Climate Plan (2021-2030) by heavily investing in the network (transmisión grid) in order to increase the share of renewable energy in the system and contribute to the transformation of the Spanish economy

- Contribute to the development of the green bond market and to the growth of impact of investments linked to the UN Sustainable Development Goals (UN SDGs)

Diversify its investor portfolio, with a focus on Socially Responsible Investors and green investors (dark green investors).