We are a global operator of essential infrastructure

- The group's investments increased by 27.6% compared to the same period in 2022, totalling €154.8 million, thanks largely to a 33% increase in investments by its subsidiary Red Eléctrica.

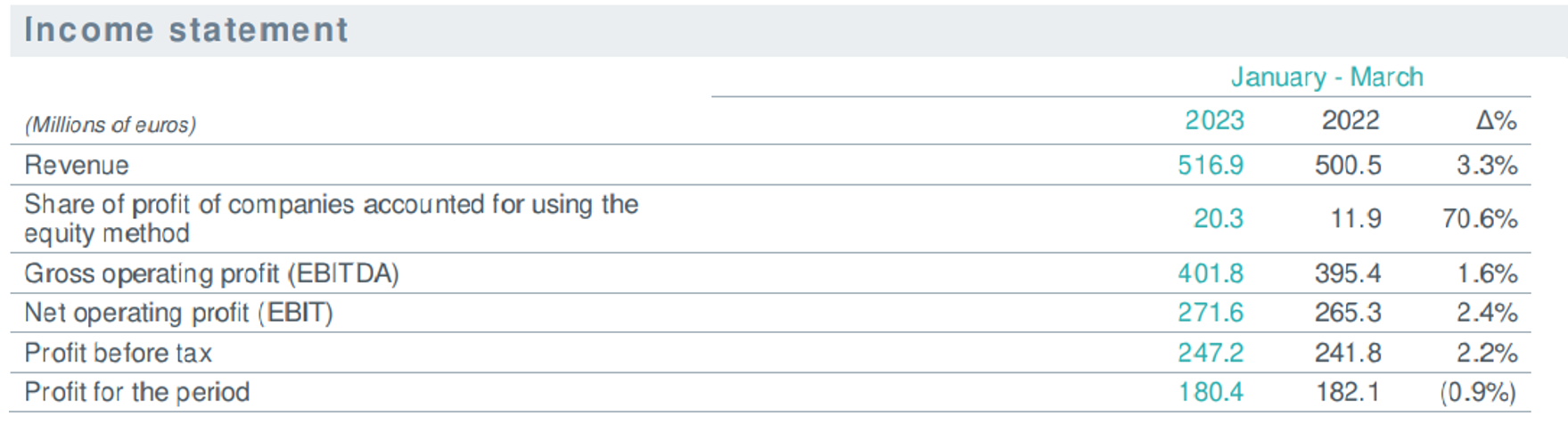

Redeia posted a net profit of €180.4 million for the first three months of 2023, similar to the figure recorded in the same period of 2022 (€182.1 million). This figure, in line with the group's forecasts, is mainly linked to the good performance of its electricity transmission operations abroad.

Revenue (turnover and profit from investee companies) amounted to €537.2 euros, up 4.8% on the figure recorded for January to March 2022. This amount shows growth in all the group’s businesses, but the positive evolution of the Company’s electricity business abroad is particularly noteworthy.

Specifically, Redinter's revenues increased by 43.2%, due to the commissioning of new facilities in Peru and Chile, the improved contribution of the investee companies and the incorporation of new assets to the scope of the company’s Brazilian subsidiary ARGO, among others.

Gross operating profit (EBITDA) amounted to €401.8 million, up 1.6% on the same period last year. The efforts made by Redeia in terms of efficiency and the good evolution of revenues and the contribution of the companies within the perimeter of Redinter in which it holds a shareholding, contributed to this figure. The net operating profit (EBIT) rose to €271.6 million, an increase of 2.4% year-on-year.

Net financial debt closed the month of March at €4,435.6 million, 4.3% lower than in the previous year. This decrease is mainly due to the issue last January of a hybrid bond, worth €500 million, with a coupon rate of 4.625% included in the group's net equity. This financial instrument has contributed to incorporating ESG criteria into 46% of the group’s financing by the end of March, compared to 42% in December 2022.

Additionally, on 9 January, an interim dividend of 0.2727 euros per share was paid out and charged against 2022 results, the same interim amount paid out last year.

Boost to investments

Redeia's investments in the first quarter of 2023 have shown strong dynamism. In line with what it announced in February during the presentation of its annual results, the group is making good progress regarding the fulfilment of its strategic plan. From January to March 2023, its investments reached €154.8 million, up 27.6% compared to the same period of the previous year.

Particularly noteworthy is the investment effort of its subsidiary Red Eléctrica to promote the green transition in Spain. The company has earmarked more than €114 million to system operation and the transmission of electricity, a figure which is 33% more than in the same period of 2022. Of this amount, €95.1 million were invested in the development of projects to strengthen and improve the transmission grid, an amount that is 25% more than in the first quarter of 2022, and €15 million have been allocated to energy storage in the Canary Islands, compared to the total of €5.1 million invested in the same period of 2022. In this regard, so far this year, the company has continued to carry out the first phase of the works of the Salto de Chira pumped storage hydroelectric power station in Gran Canaria.

Red Eléctrica continues to make progress in the execution of the current transmission grid planning with the materialisation of projects as important for the energy transition as the completion of the subsea link between Ibiza and Formentera; the initial steps of the link that will connect Tenerife and La Gomera; or the commissioning of the new Cacicedo- Astillero underground electricity line in Cantabria. Significant progress was also made on the electricity interconnection with France across the Bay of Biscay, with Inelfe already having awarded the main contracts for the execution of the project.

Also in this quarter, investment linked to the group’s telecommunications business also experienced a major boost. Hispasat increased its investment this quarter due to the launch of the Amazonas Nexus satellite that took place last February 7, reporting investments this quarter that totalled €29.4 million compared to €17.7 million invested in the first quarter of 2022. This new satellite is expected to start commercial activity next summer, once it reaches its target orbit. Meanwhile, investment in fibre optics has remained at similar levels.

In the international sphere, the investments of its subsidiary Redinter were geared towards the completion of the Tesur 4 project in Peru, which was commissioned last January.

Update of the investment programme

The group already announced in February, during the presentation of its results, that 2023 will mark a turning point in the group's investments. Specifically, it is foreseen that its subsidiary Red Eléctrica will reach a volume of more than €700 million this year, approaching the record highs of 2010 and 2011.

This means that Redeia has increased its investment targets of its Strategic Plan until 2025 to €4.8 billion compared to the originally published figure of €4.4 billion. This amount represents a 10% increase in the investments of Red Eléctrica, the Spanish TSO and backbone of the green transition in Spain.

Outstanding milestones in sustainability

As part of the most relevant milestones of this quarter, Redeia presented its 2022 Sustainability Report. This Report highlights that the activity of its main subsidiary, Red Eléctrica, is 100% environmentally sustainable as it contributes substantially to both mitigating and adapting to climate change. Thus, 79.2% of Redeia's net turnover meets the criteria and is aligned with the European Union's Taxonomy Regulation.

Redeia's commitment to sustainability also materialised last January with the aforementioned issue of green hybrid bonds to promote the green transition in Spain.