We are a global operator of essential infrastructure

- This is the company’s fourth issue of green bonds, with a duration of 10 years and offering a rate of 3.07%.

- This issue reinforces the company’s decision, taken in 2017, to seek green financing for projects that speed up Spain's energy transition.

- Redeia has set itself the goal of ensuring that it applies ESG criteria for over 60% of its financing, and raising this to 100% by 2030.

Redeia, the global operation of essential infrastructures, has today issued green bonds worth 500 million euros for a period of 10 years, with an interest rate of 3.07%, as stated in the notice sent to the Spanish National Securities Market Commission (CNMV). It is the fourth time that the company has used this form of green financing, an area where it has achieved prominence since 2017.

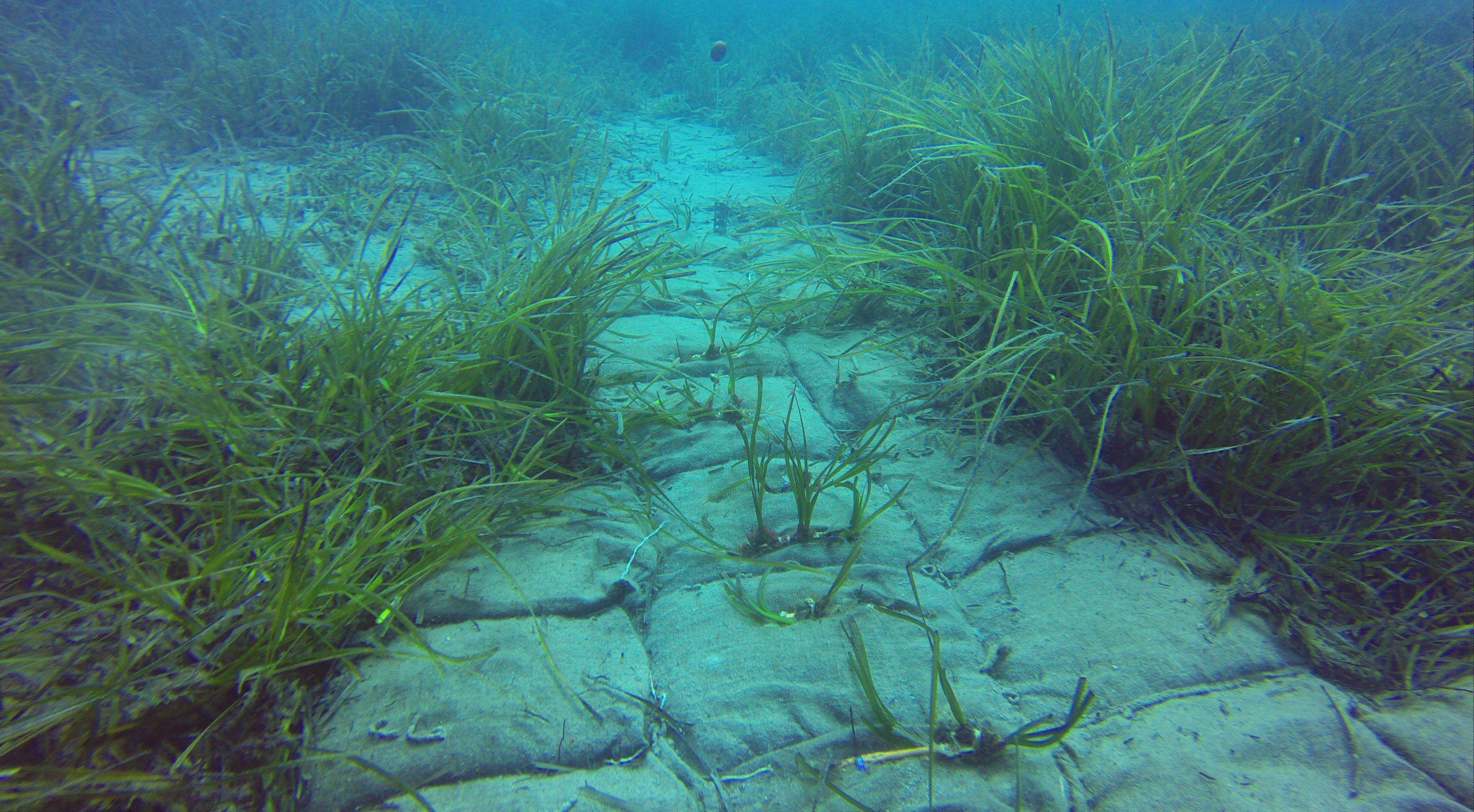

The income generated from this operation - made in a context of favourable market conditions - will allow Redeia to continue working on its strategic plan, and specifically to make the planned investments that will enable Spain’s ecological transition through the development of its transmission network. In this sense, Red Eléctrica - a subsidiary and the Spanish TSO - is making good progress with its current Network Development plan, with strategic milestones in 2023 like the link from Ibiza to Formentera, which is starting six months earlier than expected.

The demand for these bonds is as strong as previous issues, which reflects the keen interest among investors, raising more than 1.7 billion euros. For Emilio Cerezo, Redeia’s Chief Financial Officer, this good reception “shows that the investor community is fully committed to the process of decarbonising our economy, and that it is performing a vital role for sustainable development”.

This operation, which enjoyed the support of the European Investment Bank, was also supported by Barclays, BBVA, BNP Paribas, CaixaBank, Citi, ING, Mediobanca and Santander.

Leaders in sustainable finance

The company has been a leading promoter of sustainable finance for many years now. In 2017, it became the first company in the utilities sector to convert its 800 million euro syndicated load into sustainable finance by adding environmental, social and governance (ESG) criteria to the interest rate offered. From that time on, the company has included these ESG criteria in its financing in all its business areas.

In October 2019, it presented its Green Framework to align its financing with the company’s sustainability strategy. The company later adapted this green framework to the taxonomy of the European Union, which classifies 79.2% of Redeia’s activities as environmentally sustainable.

In January 2020, Redeia made its first issue of green bonds for a total of 700 million euros, to finance projects eligible under its Green Framework, which were well received by the market. The company continued to pursue this strategy in 2021 with the issue of a new green bond - for 600 million euros - achieving the lowest credit margin in the last decade. In 2023, Redeia went one step further, opting to offer perpetual hybrid green bonds worth 500 million euros at a rate of 4.625% for the first time.

For the future, Redeia has set itself the goal of applying ESG criteria for 100% of its financing in 2030, with a floating goal of 60% in 2025, as set down in its Sustainability Plan 23-25. According to the latest data, published on 30 September 2023, this figure stood at 59% and would amply exceed 60% after this operation.