We are a global operator of essential infrastructure

The company has just finalised an investment of 564.2 million euros in Red Eléctrica. Of that total, 517 million euros were earmarked for the implementation of strategic grid projects, critical to supporting the country's industrial development.

On 8 July of this year, Redeia paid out the additional dividend of 0.60 euros per share, bringing the total dividend for the previous financial year to 0.80 euros per share.

Redeia continues to accelerate its investment plan to strengthen Spain’s electricity transmission grid, thereby reinforcing its role as a driver of the green transition and a catalyst for the country’s industrial roll-out. Of the 602.7 million euros invested by the group in the first half of 2025, 564.2 million euros went to developing the transmission grid and operating the electricity system.

This investment in the TSO (Transmission System Operators) represents a 33.9% increase over the first half of the previous year. The investment effort dedicated to developing the national transmission grid has been particularly intense, with 517 million euros allocated to this area, a 41% increase compared to the same period last year, when the figure stood at 366.7 million euros.

The group is thus moving forward with the investment roadmap it set out at the beginning of the year. As reaffirmed at the last Shareholders' Meeting on 30 June, its main objective is to exceed 1.4 billion euros by the end of the year, a historic figure for the company.

Key milestones for the first half of the year

With this momentum, Red Eléctrica is making progress on strategic projects included in the current electricity Planning. Among the key milestones in the first six months of the year are advances in infrastructure such as the interconnection between Spain and France via the Bay of Vizcaya, where significant progress has been made on the onshore section. In the field of interconnections, notable developments also include the links between Tenerife and La Gomera, as well between the Spanish peninsula and Ceuta, both of which will see the start of submarine cable laying this summer.

Other important recent commissioning highlights include Ibiza’s southern axis, essential for strengthening the security and quality of electricity supply on the island, and the substation in Calera y Chozas, Toledo, which plays a key role in supporting the region’s productive infrastructure and rail transport. In terms of industrial support, the new Abrera substation in Barcelona has been commissioned, along with the expansion of Espartal in Zaragoza. The first phase of the 220 kV Saguntum substation has also been completed, and its electromechanical installation is already underway.

In addition, beyond the Planning, Red Eléctrica is making steady progress on the construction of the Salto de Chira pumped-storage hydroelectric power station in Gran Canaria.

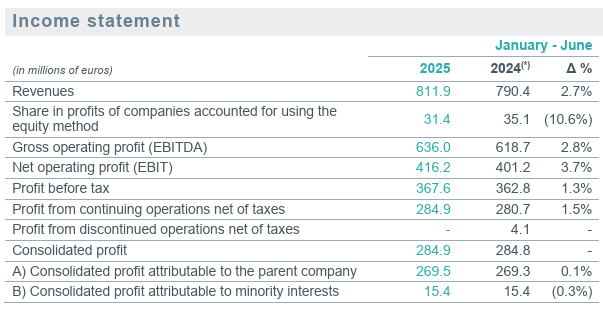

Thanks to this strong investment momentum, the company remains on a path of revenue growth. Specifically, revenue (including business turnover and the share of profits from equity-accounted companies) stood at 843.3 million euros, a 2.2% increase compared to the 825.6 million euros recorded at the end of the first half of 2024.

By business area, the management and operation of national electricity infrastructure generated revenue of 714.9 million euros, 3.4% higher than in the same period of the previous year. International electricity transmission activity contributed 72.2 million euros, while the fibre-optic business generated 74.5 million euros in revenue.

Gross operating profit (EBITDA) reached 636 million euros, a 2.8% increase compared to the first half of 2024, while net operating profit (EBIT) stood at 416.2 million euros, up 3.7%. On the other hand, the group's net profit stood at 269.5 million euros, in line with the same period of the previous year. It is worth noting that consolidated profit from continuing operations rose by 1.5%.

As of 30 June 2025, net financial debt stood at 5.539,4 billion euros, an increase of 169,6 million euros, due to the company’s significant investment activity during the period. This was partially offset by the cash flow generated from operations and approximately 21 million euros in grants received under the Spain-France electricity interconnection project.

The half-year financial statements were reviewed by the Group’s auditor (EY), who issued a favourable opinion.

Regarding dividends, on 8 July, Redeia paid the additional dividend for the 2024 financial year amounting to 0.60 euros per share. As a result, the total dividend paid for that year amounts to 0.80 euros per share, as outlined in the group’s strategic plan.

80% of group financing is sustainable

In line with its commitment to associate its funding with ESG criteria, the company has increased the share of its financial debt issued under sustainable criteria to 80%, up from 69% as of December 2024. Therefore, Redeia has surpassed its midterm target of 60% set for 2025 and is moving towards the goal of 100% by 2030.

As part of this effort, the company continues to move forward with its Comprehensive Impact Strategy (EIIR), through which it promotes territorial development. So far, 239 initiatives have been launched under this strategy in both Spain and Latin America, funded by approximately 17 million euros.