We are a global operator of essential infrastructure

- New infrastructure projects throughout the territory for industrial deployment are advancing at the expected pace, as are the interconnections with France, Portugal, between the Peninsula and Ceuta, and in the archipelagos.

- In line with the company's forecasts, gross operating profit (EBITDA) for the first nine months of the current financial year reached €950.9 million, 3% more than in the same period of 2024.

- The Board of Directors has approved the distribution of an interim dividend of €0.20 per share charged to the 2025 results, to be paid in January 2026.

Redeia continues on its planned investment path to strengthen electricity transmission infrastructure in Spain, which is key to the energy and industrial transformation process the country is undertaking. From January to September 2025, the company allocated €834 million to this activity, almost 59% more than in the same period of 2024. In total, the investment effort in Red Eléctrica—transmission and system operation—amounted to €915 million as at 30 September, moving towards the commitment of achieving an investment of over €1.4 billion in the TSO in 2025.

At a global level, the group's total investments during the first nine months of the year amounted to €967.5 million, 47.6% more than in the same period of 2024.

Progress throughout the territory

This roadmap highlights significant progress during the third quarter on projects such as the electrical interconnection between Spain and France via the Bay of Biscay; the interconnection axis with Portugal through Galicia; and the links between the Peninsula and Ceuta, and between La Gomera and Tenerife, where the laying of both routes took place this summer (in Ceuta's case, the second cable will be installed this autumn). Likewise, from June to September, recent commissioning projects also stand out, such as the expansion of the Benahadux substation (Almería), essential for the electricity supply to the Mediterranean corridor, and the Pesoz substation (Principality of Asturias), which strengthens the supply to Western Asturias and increases renewable integration capacity. In Navarre, Red Eléctrica recently began construction of the Tierra Estella–Muruarte line, essential for supplying industry, which has been declared of regional interest.

Revenue and results

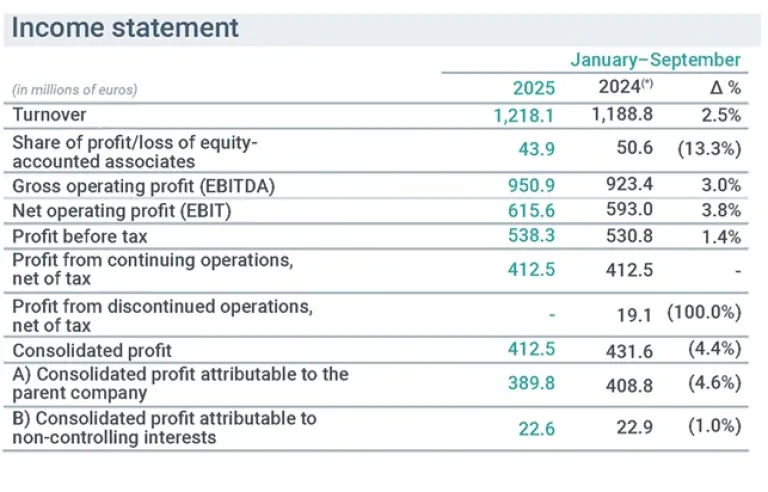

So far this year, Redeia has maintained its growth rate: in total, cumulative revenue in the first nine months of the year (turnover and share of profit/loss of equity-accounted associates) reached €1,262 million, 1.8% more than the €1,239.5 million recorded between January and September 2024.

By activity, the management and operation of national electricity infrastructure achieved a turnover of €1,073.1 million, which is 3.2% more than that recorded in the same period of 2024. Meanwhile, international electricity transmission reached a turnover and profit from equity-accounted associates of €104.3 million, and fibre optic generated €111.8 million.

Gross operating profit (EBITDA) for the first nine months of the current financial year reached €950.9 million, 3% more than in the same period of 2024. As for net operating profit (EBIT), it stands at €615.6 million, 3.8% higher, and the group's net profit amounts to €389.8 million, in line with the company's forecasts. Profit from continuing operations, net of tax remains unchanged from the €412.5 million in the January–September 2024 period and is in line with the group's forecasts.

On the other hand, net financial debt at the end of September stood at €6,083.4 million, 13.3% (€713.6 million) more than at 31 December 2024, which is mainly due to the strong investment pace.

Regarding the dividend, the Board of Directors has approved the distribution of an interim dividend of €0.20 per share charged to the 2025 results, to be paid in January 2026, in line with the dividend policy established in the company's strategic plan to 2025. This policy establishes a floor of €0.80 per share for the dividend charged to the 2025 financial year results.

80% of group financing is sustainable

In line with its commitment to continue linking its financing to ESG criteria, the company has increased its contracted financial debt with sustainable criteria to 80%, up from 69% in 2024. In this way, Redeia surpasses the 60% interim target it had set for 2025 and is advancing towards the 100% horizon set for 2030.

In this context, this September Redeia launched its sixth green bond issue for a total of €500 million. This financing will allow it to accelerate its investments in electrical grids to meet new demand and continue consolidating the ecological transition in Spain.

Finally, in accordance with this Sustainability commitment, the company promotes infrastructure development by fostering a positive impact on the territory through its Comprehensive Impact Strategy, with which it has already mobilised €18 million to launch more than 250 social and environmental initiatives in both Spain and Latin America. This was noted during the 2025 Sustainability Conference, held this October, where the company announced that, having completed the current Sustainability strategic plan, it is now designing a new one with a 2029 horizon.