We are a global operator of essential infrastructure

-

The Board of Directors has approved the distribution of an interim dividend of 0.2727 euros per share paid against 2022 profits, similar to the amount distributed last year.

-

The subsidiary of the Group responsible for the operation and transmission of the electricity system in Spain, Red Eléctrica, is making progress on strategic projects included within the Electricity Transmission Grid Planning, with an investment that is 9.3% higher than that recorded in the first nine months of 2021.

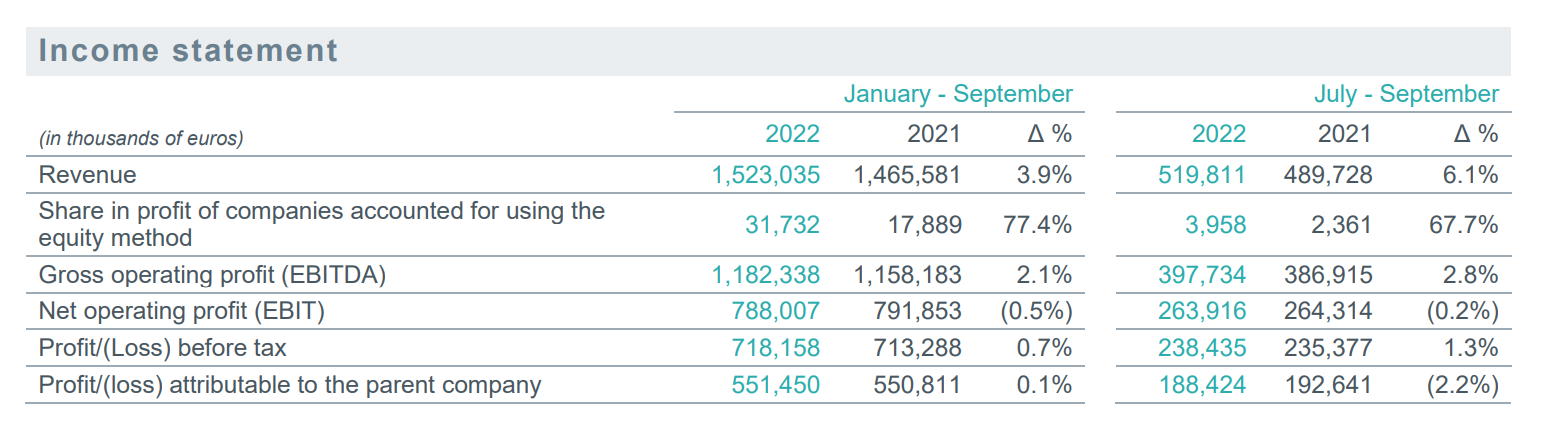

Redeia posted a net profit of €551.4 million for the first nine months of 2022, similar to the figure in the same period in 2021 (€550.8 million). This result, in line with the Group's forecasts, is largely linked to the good performance of the electricity transmission operations abroad.

Total revenues (revenue and profit of the investees) totalled €1,554.8 million, 4.8% higher than the figure recorded from January to September 2021. This figure shows growth in all business lines of the Company, although the electricity transmission business abroad and the satellite and fibre optic business is particularly noteworthy. Specifically, the revenues of the Group's international subsidiary, Redinter, increased by 60.4%, as a result of the projects that have been completed this year in Peru and Chile, the good performance of Argo's activity in Brazil, driven by the commissioning of the Argo II and the acquisition of Argo IV and the updating of the remuneration parameters and the favourable effect of the currency exchange rate. Regarding the telecommunications business, the Group's satellite subsidiary, Hispasat, registered increased sales, amounting to €6.3 million, and €18.1 million due to changes in the accounting scope.

Gross operating profit (EBITDA) reached €1,182.3 million, 2.1% more than in the same period of the previous year. The efforts made by Redeia in terms of efficiency and the good performance of turnover and the results of the electricity transmission business abroad, as well as of the satellite and fibre optic business lines, all of which have contributed to this figure. EBIT stood at €788 million, 0.5% less than that registered in the same period of 2021.

Net financial debt closed September at €4,398.1 million, down 22.1% year-on-year. This decrease in debt is explained, among other reasons, as a result of the sale of 49% of the shareholding of REINTEL, the Company’s fibre optic subsidiary, to KKR, which contributes to strengthening Redeia’s equity in order to meet the challenges of the green transition.

These results bolster the Company's solid financial position. In this regard, on 14 October, the credit rating agency Fitch Ratings ratified Redeia's rating at 'A-' with a stable outlook. Previously, on 26 April, Standard & Poor's had rated the Company with the same rating. At the end of September, 42% of the Company’s financing incorporated ESG criteria, a figure that is noteworthy compared to the 35% reported in December 2021.

With regard to the dividend payout, the Board of Directors approved the distribution of an interim dividend of 0.2727 euros per share paid against 2022 profits, an amount similar to the amount paid out last year. The Company plans to pay the dividend on 9 January 2023.

Boost to investments

Redeia's investments from January to September registered an increase of 38.9%, reaching a total of €484.9 million.

Specifically, the investment earmarked by Red Eléctrica for transmission grid development in Spain totalled €272.2 million, up 9.3% on that reported for the first nine months of 2021. Of note is the completion of the Lanzarote-Fuerteventura inter-island connection and the execution of the works associated with the link that will connect Ibiza with Formentera; a project that is currently in the first stages of execution.

Important work has also been carried out on the renovation and development of grid assets encompassed within the 2021-2026 Plan. Of particular note in this regard are the Sabinal axis in Gran Canaria, the Caparacena - Baza - La Ribina axis in Andalusia and the Madrid East Plan axis. Work has also continued on the first phase of the Salto de Chira reversible pumped-storage power station in Gran Canaria, the first major energy storage project on the island.

Regarding investment, noteworthy is the investment linked to the management and operation of electricity infrastructure abroad, which is managed by the subsidiary Redinter. Specifically, investment has increased in Peru in the Tesur 4 project, which is expected to be commissioned at the end of this year, and also in Chile in order to complete the Redenor project, which is expected to be formalised in the near future.

With regard to telecommunications activity, investment in the satellite business included €118 million for the acquisition of the satellite company Axess Networks, a transaction that was carried out in August. Investment in fibre optics in the first nine months of the year was slightly higher than in the previous year.

Additionally, €22.3 million has been earmarked for other investments that include infrastructure for the Group and investments developed by Elewit, Redeia's technological platform.

Main highlights

Among the most significant milestones in the first nine months of the year, noteworthy is that at the end of July, Redeia and Grupo Energía Bogotá, through Argo Energía, reached an agreement with the investment fund Brasil Energia FIP to acquire 100% of the shareholding of five transmission lines in Brazil for a value of 4,318 million Brazilian reals.

For Redeia, this transaction represents an investment of around €200 million. Once this transaction is closed, subject to compliance with Brazilian regulatory authorities, Argo will double in size and manage 4,125 km of line circuit in Brazil, positioning itself as a leader in the northeast region of the country.

In August, after obtaining all the necessary authorisations, Hispasat closed the previously indicated acquisition of Axess Networks; this transaction is part of the actions defined in the 2021-2025 Strategic Plan for Redeia's satellite business. Hispasat is also making progress in the development of its new Amazonas Nexus satellite, which is expected to be launched in the first quarter of next year.

Boosting our commitment to sustainability

Redeia has continued to adapt and evolve its commitment to sustainability. Around 80% of the Company’s actions in the first nine months of the year have been environmentally sustainable, according to European Taxonomy. In addition, its satellite subsidiary, Hispasat, renewed and extended a credit facility, which introduces ESG criteria and indicators for the first time in the Company.

In order to continue making progress along this path, this week, the Board of Directors approved the 2023-25 Sustainability Plan, which establishes, among other targets, a 30% reduction in Scope 1 and 2 emissions compared to 2019. In addition, it proposes that all investment projects contribute to the protection of vegetation and the fight against deforestation. On the other hand, in terms of gender equality, noteworthy is the Company’s commitment to achieving parity on its Board of Directors and to the objective that the share of women on the management team reaches 38%.