We are a global operator of essential infrastructure

- The company continues to speed up its investment plan in Red Eléctrica to drive the ecological transition in Spain, reaching almost 140 million euros invested between January and March.

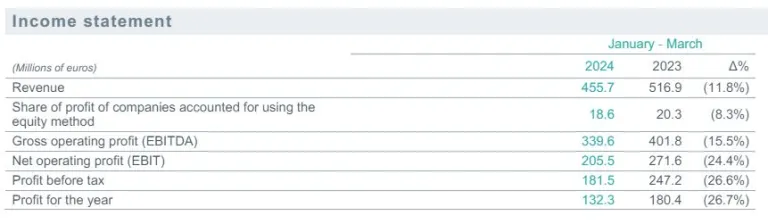

- The group's results in this period were marked by the end of the regulatory useful life of pre-1998 assets, with revenues amounting to 474.3 million euros and a net income of 132.3 million euros.

- Credit ratings confirm the company's financial stability, with the S&P agency's 'A-' rating confirmed, with a stable outlook this April.

Redeia continues to increase its investment in the transmission grid, the backbone of the ecological transition in Spain, and in the operation of the electricity system. In first quarter of this year, Red Eléctrica's investments amounted to 139.3 million euros, representing an increase of 22% compared to the investments made in the same period of the previous year. In relation to investments in the development of the transmission grid, the amount increased to 25%, with almost 119 million euros allocated to this item compared to 95 million euros in Q1 of 2023. The Redeia group's total investments amounted to 156 million euros.

This is in line with the company's annual target of reaching 1 billion euros of investment, the highest in its history, with the aim of continuing to promote and facilitate the national energy transformation process.

These resources have resulted in further progress in the implementation of the projects included in the current electricity plan. In the first three months of the year, the new Cerdà 220kV substation, essential for the electrification of the Port of Barcelona and the promotion of industry in the Zona Franca and the airport, was commissioned. In the same province, work has also begun on the extension of the Abrera 220 kV substation, which will be essential for electrification projects in the automotive sector in Martorell. The investment boost has also allowed work on the Tenerife-La Gomera link to continue, as well as progress to be made on the new strategic interconnections with France and Portugal, which are essential for the integration of renewables and energy independence.

Beyond Planning, the construction of the Salto de Chira pumped-storage hydropower plant in Gran Canaria, which is key to energy transformation in the Canary Islands, continues to make good progress.

Revenues and results

Revenues (turnover and the share in the profits of companies accounted for using the equity method) amounted to 474.3 million euros, mainly due to the impact of the end of the remunerative useful life of facilities with operating licences prior to 1998, known as pre-98 assets, introduced by Royal Decree 1047/2013 of 27 December. Since this change in the methodology for calculating remuneration from transmission, much of the company's management has been focused on preparing for this moment, including it in the current 2021-2025 Strategic Plan. In recent years, the organisation has been building the necessary capabilities to significantly increase investments, so much so that 2024 will be a turning point for strong future revenue growth.

The end of the life of these assets resulted in a lower contribution from transmission activity in the electricity infrastructure management and operation business, which ended the quarter with revenues of 344.5 million euros. System operation activity, on the other hand, generated 1.2 million euros more than in the same period of 2023.

The telecommunications business generated 101.3 million euros in the first quarter of 2024, exceeding the figure for the same period of 2023 by more than 4 million euros. This is due to the performance of the satellite business, which improved by 6.3% year-on-year to almost 63 million euros, with a significant contribution from the new Amazonas Nexus satellite. Results also showed an improvement in the fibre optic business, which generated 38.6 million euros in revenues. Revenues from international electricity transmission, including the results of investee companies, amounted to 36.4 million euros.

Gross operating profit (EBITDA) reached 339.6 million euros, while net operating profit (EBIT) amounted to 205.5 million euros and the group's net profit at 132.3 million euros, in line with the company's forecasts.

Net financial debt at 31 March 2024 stood at 4,892.2 million euros, 1.7% lower than at the end of 2023. In terms of its financial structure, the company maintains a solid position, with a diversified debt in terms of sources of financing and an 'A-' credit rating that the S&P agency confirmed on 12 April, with a stable outlook; the same rating as the one granted by Fitch last October.

In terms of dividends, the Board of Directors will propose to the General Meeting of Shareholders that a dividend of 1 euro be paid charged to the results of financial year 2023. From this amount we must deduct 0.2727 euros per share paid on account last 5 January. The final dividend of 0.7273 euros will be paid on 1 July.

The share of sustainable financing now stands at 62%

In the first quarter, in line with its commitment to sustainability and to continue linking its financing to ESG criteria, Redeia launched its fourth green bond issue on 3 January for 500 million euros. The operation allowed the company to increase its financial debt agreed with sustainable criteria to 62% at the end of March 2024, compared to 59% in December 2023. Thus, Redeia is moving towards its goal of achieving 100% sustainable financing by 2030.

Among the highlights of this quarter, Redeia presented its 2023 Sustainability Report, the company's 20th. It highlights the fact that last year Redeia spent 24.9 million euros on environmental issues such as protecting biodiversity and integrating its facilities into the landscape; and 10.6 million euros on initiatives that combat territorial, digital, gender and intergenerational inequality. Additionally, thanks to the 'Redeia Forest' project, more than 1,000 hectares of forest area have already been recovered, having planted more than 852,000 trees across the country since its launch in 2009 to combat climate change and the loss of biodiversity. In this quarter, the company was also recognised by Equileap (Gender Equality Report & Ranking) as the third most egalitarian company in Spain.