We are a global operator of essential infrastructure

- The investments made by the subsidiary Red Eléctrica to enable the ecological transition in Spain increase by 88.4 % by September, reaching 512.9 million euros.

- The Board of Directors has approved the payment of an interim dividend of 0.2727 euros per share against 2023 results, an amount similar to that distributed last year.

- The credit rating agency Fitch has ratified in October the group's rating at an A- level, with a stable outlook.

Redeia has increased its revenues by 2.8 % over the first nine months of the year, totalling 1,597.8 million euros (turnover and results of investee companies), thanks to the boost provided by diversification businesses.

A good performance by the international electricity transmission operations and the evolution of the telecommunications business have offset the slight drop in revenues caused by the regulated business in Spain due to the application of the new criteria for the commissioning of facilities established by the regulatory authority.

Specifically, the revenues generated by Redinter were 28.8 % higher than those recorded at September 2022, mainly due to the commissioning of the second stage of the Redenor project in Chile, in September 2022, and of Tesur 4, in Peru, in January last year. The incorporation of new assets to the perimeter of the Brazilian joint venture Argo and a better result at TEN (Chile) also contributed to these results.

Revenues in the telecommunications business were 11.2 % higher compared to the previous year, thanks to the contribution of the satellite subsidiaries —largely due to higher revenues from Axess, which joined the consolidation perimeter of the group at the beginning of August last year— the contribution of the new Amazonas Nexus satellite and the fibre optics business.

The gross operating profit (EBITDA) reached 1,183.1 million euros, which is in line with the figure obtained in the same period of the previous year (+0.1 %). These figures are mainly the result of a positive evolution of turnover and the contribution of the companies in which Redinter has holdings within the scope of Redinter. The net operating profit (EBIT) reached 790.1 million euros, up by 0.3 %, while net profit amounted to 535.3 million euros.

Net financial debt at the end of September stood at 4,970.6 million euros, 7.3 % higher than that recorded at the end of the previous year, mainly due to the repayment of excess rates collected in previous years. At 30 September, the group's financing including ESG criteria stood at 59 %, compared to 42 % at 31 December last year. Redeia has set itself the target of achieving 100 % financing under ESG criteria by the year 2030.

Redeia relies on a solid financial position. In this regard, the credit rating agency Fitch ratified its rating at “A-” with a stable outlook on 9 October, as did Standard & Poor's in June, confirming its rating at “A-/A-2” with a stable outlook.

As for the dividends, the Board of Directors has approved the payment of an interim dividend of 0.2727 euros per share against 2023 results, an amount similar to that distributed last year.

Investment

Redeia continues to accelerate its investment plan, remaining consistent with the targets set out in its Strategic Plan 2025. Up to September 2023, the investments made by the group have exceeded 621 million euros, an increase of 28.2 % over the same period of the previous year.

Of particular note are the efforts undertaken by the company to accelerate the process of ecological transition in Spain through Red Eléctrica, its subsidiary responsible for the operation of the Spanish electricity transmission system. In this regard, the TSO allocated 512.9 million euros in the period from January to September, an 88.4 % increase over the same period of the previous year, thus advancing towards meeting the forecast announced in February, to end the year with an investment volume above 700 million euros, nearing the historical maximum. This boost to the investment plan has been particularly significant in the latest quarter, with investments multiplied by 2.3 times compared to those carried out in the same period of 2022.

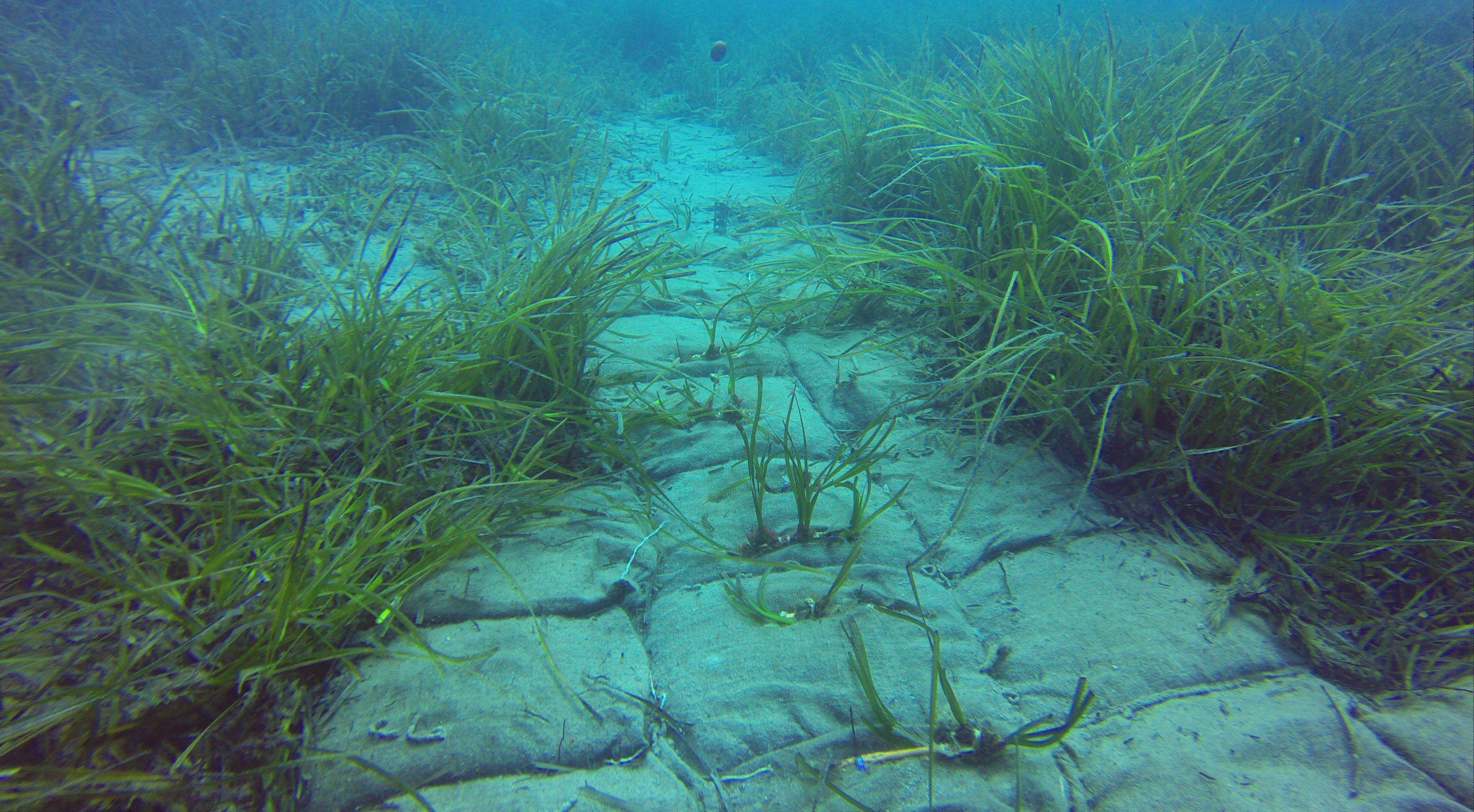

Thanks to this investment programme, the company has made progress in the development of strategic projects included in the Network Development Plan 21-26. It has recently brought the Ibiza-Formentera link into service (six months ahead of schedule) and has made progress in the strategic works such as the link that will connect Tenerife with La Gomera, among others.

Beyond Planning, the subsidiary has earmarked 34.6 million euros to continue with the first phase of work on the Salto de Chira reversible pumping station in Gran Canaria.

In the telecommunications business, Hispasat has allocated 69.8 million euros, mainly focused on the new Amazonas Nexus satellite and its commercial deployment, which has already generated revenues of 8.9 million euros since it came into operation in July. Investment in the fibre optic business amounted to 6.9 million euros, some 2.7 million euros more than last year.

Internationally, the subsidiary Redinter has seen a reduction in investment levels following the completion of its major investment projects in Chile and Peru.