We are a global operator of essential infrastructure

- This figure represents a decrease of 2.3% compared to 2021 mainly explained by the regularisation of transmission revenues from the electricity business in Spain.

- Investments totalled €1,032.3 million, nearly 80% more than in 2021 due to corporate transactions and a 25% increase in investments for the energy transition.

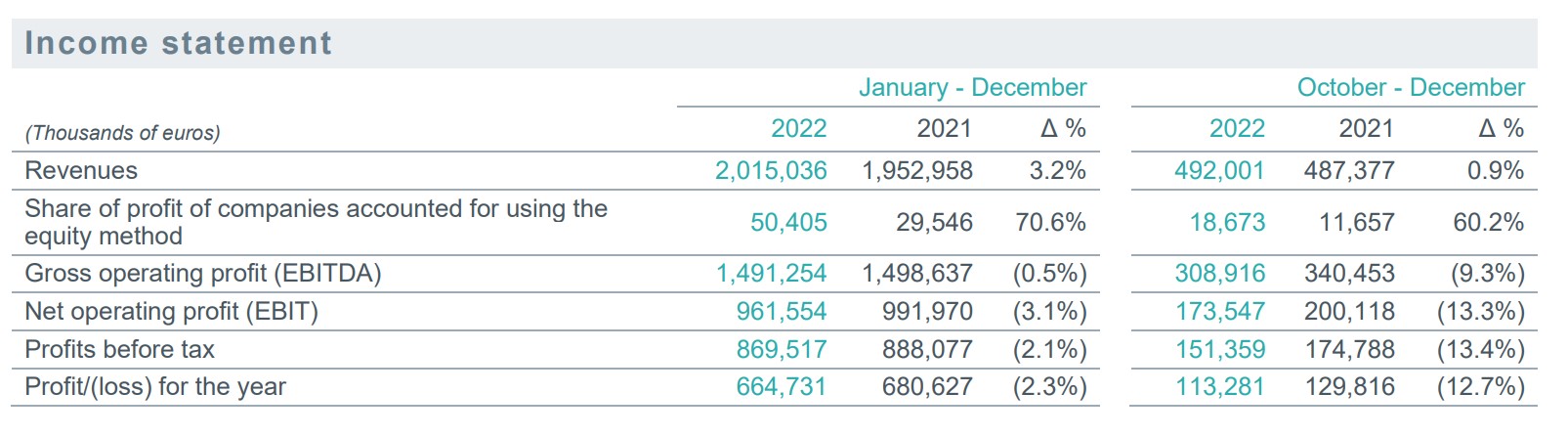

Redeia has announced a profit of €664.7 million for year-end 2022. This figure represents a decrease of 2.3% compared to 2021, mainly explained by the regularisation of transmission revenues and higher expenses in the management and operation of electricity infrastructure in Spain.

Income (revenue and share in the profits of companies accounted for using the equity method) totalled €2,065.4 million, up 4.2% on the previous year. This good figure reflects growth in practically all the businesses, noteworthy among which is the evolution of the electricity activity abroad and that of the telecommunications business.

Specifically, the management and operation of electricity infrastructure closed 2022 with lower revenues due to the application of Orders TED/1311/2022 and TED/1343/2022, which establish the definitive remuneration for 2016-2019. Without this impact, revenue would have been higher than in the previous year.

On the other hand, the international subsidiary Redinter reported higher revenues due to its organic growth in Chile and Peru and the contribution of the results of the Brazilian subsidiary ARGO after the commissioning of Argo II and Argo III and acquiring 5 new concession contracts, in addition to the favourable effect of the exchange rate. Regarding Hispasat, it reported higher sales, a positive contribution from the exchange rate and also experienced changes in the accounting perimeter due to the inclusion of Axess since August and the full year of the businesses acquired in 2021 in Peru. In the case of the fibre optic business, Reintel has increased revenues thanks mainly to its commercial activity and the inflation-linked nature of its contracts.

Gross operating profit (EBITDA) totalled €1,491.3 million, 0.5% lower than that generated in 2021. This result would have been positive, specifically an increase of 1.8%, had it not been for the aforementioned regulatory adjustments. The efforts made by Redeia in terms of efficiency and the good performance of revenue and the results of the electricity business abroad and the satellite and fibre optic businesses contributed to this figure. EBIT totalled €961.6 million, down 3.1%.

Net financial debt closed the month of December at €4,633.8 million, 18% lower than in the previous year. This decrease is explained, among other reasons, by the sale to KKR of 49% of the fibre optic subsidiary, Reintel.

These results bolster the company's solid financial position. In October, Fitch Ratings ratified Redeia's rating at 'A-' with a stable outlook. Previously, in April, Standard & Poor's had granted the company the same rating.

Regarding the dividend, the Board of Directors will submit to the General Shareholders' Meeting the distribution of a dividend of 1 euro per share charged against 2022 results. The 0.2727 euros per share paid as an interim dividend on January 9 must be deducted from this amount. The additional dividend of 0.7273 euros is expected to be paid in July.

Investments: 25% more to boost the green transition

Redeia's investments from January to December totalled €1,032.3 million, an increase of almost 80% compared to 2021. The evolution of this amount is marked by the investment effort made in the management and operation of electricity assets in Spain, which in 2022 was 25% higher, standing at €532 million.

Regarding the foregoing, the investment effort allocated to the execution of strategic projects of the 2021-2026 Transmission Grid Planning, essential to continue advancing in the process of green transition, is especially noteworthy. Specifically, in recent months Red Eléctrica has completed the underwater electricity link between Ibiza and Formentera, has commissioned the Caparacena - Baza electricity axis in the province of Granada, has completed the link between Lanzarote and Fuerteventura and has made progress in the processing of the Tierra Estella electricity axis in Navarra.

Similarly, and beyond Planning, the subsidiary has also continued to make progress in the construction of the Salto de Chira pumped storage hydroelectric power station in Gran Canaria, investing €64.2 million for this purpose.

These figures are also the result of the group's corporate transactions: the acquisition of five new concession contracts in Brazil through Argo, which involved an investment of €200 million for Redeia, and the acquisition of Axess by Hispasat for €120 million. From an organic point of view, noteworthy are the investments in the new Amazonas-Nexus satellite for €62 million.

In the international arena, in addition to the aforementioned transactions, it is also worth mentioning that Redinter has completed the following projects: the Nueva Pozo Almonte - Parinacota line in Chile, and the line between Tintaya and Azángaro in Peru; both have already been commissioned.

Regarding the fibre optic business, Reintel has increased its investment in the renewal of cables. Additionally, €47.1 million were allocated to infrastructure for the group and investments in Elewit, Redeia's technology platform.

Milestones: progress made in sustainability and connectivity

In 2022, Redeia continued to strengthen its commitment to sustainability, being one of the most sustainable companies in the world, as reflected by its inclusion in the Dow Jones Sustainability Index. In October, the company presented its new Sustainability Plan, which sets out 87 objectives and 190 measures to be fulfilled by 2025. Among other aspects, it should be noted that Redeia has set a target for 100% of its financial debt in 2030 to be contracted with ESG criteria. In line with the achievement of this target, as at 31 December 2022, the level of the group’s financing that includes ESG criteria rises to 42%, standing at 35% at 31 December of the previous year.

Redeia is a benchmark in the field of sustainable financing, a position it has continued to consolidate with new milestones. Earlier this year, on 24 January, the company issued its first green hybrid bond, an issue that was made for €500 million. The funds raised will be used to implement the 2021-2026 Plan, in line with Redeia's current Strategic Plan and Green Financing Framework.

Furthermore, the group reached a major milestone in the telecommunications field this month. On 7 February, Hispasat successfully launched its new satellite, the Amazonas Nexus, from Cape Canaveral, thus opening a new era in satellite communications. The Amazonas Nexus will enable high speed internet access to the entire American continent, the North and South Atlantic corridors and remote areas such as Greenland and the Amazon rainforest.