We are a global operator of essential infrastructure

Red Eléctrica de España has presented the 2011 consolidated results, within the framework of the Business Plan 2011-2015. These results reflect for yet another year the growth trend and the strong investment rate of recent fiscal years, therefore fulfilling the commitments acquired by the company.

A result of this effort has been the commissioning of 1,739 kilometres of new circuits, 247 substation positions and 2,700 MVA of additional transformer capacity. All this has represented an investment in the transmission grid equivalent to 818.9 million out of a total of 844.3 million euros.

Noteworthy, amongst these assets, are: the submarine electricity interconnection between the Spanish peninsula and the Balearic Islands; the Bescanó substation, a key installation to strengthen the electricity supply in the northeast of Catalonia and for the interconnection with France; and the Penagos substation, that forms a part of what is known as the "northern axis", a project that will connect all the north of the peninsula by means of electricity transmission lines.

As a result of the increased activity and the growth of the company, the headcount has increased 2.1%.

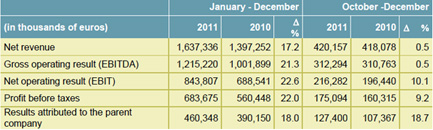

Group profits in 2011 were 460.3 million euros, 18% higher than those last year that reached 390.2 million euros. The transmission assets, mainly assets on the Spanish islands, acquired from Endesa, Unión Fenosa and Hidrocantábrico in the middle of 2010 were included in the 2011 fiscal year results. This is the first fiscal year in which these assets have been fully remunerated for the complete year.

Gross operating result (EBITDA) reached 1,215.2 million euros, which represents a growth of 21.3% with respect to the figure in 2010. This is a consequence of the 17.2% increase in net revenue, due to the incorporation of the transmission assets, as well as to a smaller increase in operating expenses that grew 5%.

With regard to financial debt, at year end it reached 4,692.9 million euros, 63.7 million less than the previous year, in spite of the high volume of investments. At 31 December Red Eléctrica counted on liquidity in excess of 1,600 million euros, a figure similar to the maturity of the debt that the company has over the next two years.

Income statement

Relevant events

In this month of February, Red Eléctrica carried out a bond issue, for a total of 250 million euros and with a maturity due in April 2020. With this operation the company completes the refinancing of the needs for 2012, 2013 and 2014.

Red Eléctrica maintains a credit rating of 'A+' by Standard & Poor's, and 'A2' by Moody's, a step above that of the Kingdom of Spain in both cases.

The results will be approved in the General Shareholders' Meeting. Also to be submitted for approval is a dividend corresponding to the 2011 fiscal year of 2.2124 euros per share, of which an interim dividend of 0.6764 euros was paid out on 2 January, maintaining the pay-out at 65%.

Business Plan 2011-2015

The 2011 results are framed within the Business Plan 2011-2015 presented last year. With respect to this plan, the volume of investments of the previous year were maintained; with 800 million euros of annual investment in the transmission grid.

This investment effort is essentially destined to the development of the infrastructures plan and to the integration of not only renewable energies, in an efficient and reliable manner, but also of the transmission assets on the Balearic Islands and Canary Islands acquired in the middle of 2010, with the aim of adapting them to the quality standards of REE infrastructures on the Spanish peninsula.

All this whilst maintaining a solid capital structure and working to guarantee the supply with quality and efficiency.