We are a global operator of essential infrastructure

- Red Eléctrica's investment reached €825 million, bringing the group's total investments to around 1 billion euros.

- The group increased its profits by 3.7% year-on-year, reaching €690 million at the close of 2023.

- The Board of Directors will propose to the General Shareholders' Meeting the distribution of a dividend of 1 euro per share to be charged to 2023 results, of which 0.2727 euros per share has already been paid in January

Redeia is accelerating its investment to further bolster the transmission grid, the backbone of the green transition in Spain. At the end of the year, the group's total investments amounted to €996.2 million, of which €825 million went to Red Eléctrica, the Spanish TSO. This last figure, which represents an increase of 55% compared to the previous year's investment, meets in full the objective of exceeding the €700 million investment target set at the beginning of the year. This clearly shows that 2023 has been a turning point in terms of investment in key infrastructure to help make the energy transition possible.

This investment effort has enabled great progress to be made in executing the current Transmission Grid Planning. Among the investments made, noteworthy is the completion - six months ahead of schedule - of the new subsea link between Ibiza and Formentera, the progress in the works to link Tenerife with La Gomera; or the commissioning of the Cerdá substation, essential for the electrification transformation of the Port of Barcelona. In addition, noteworthy was the progress in the initial works of the strategic cross-border connections with France and Portugal, essential for the integration of renewables and energy autonomy. In addition to the projects and assets related to the Transmission Grid Planning, important resources were invested in the development of energy storage, with the construction of the Salto de Chira hydroelectric power station in Gran Canaria.

Increased revenues and profits

Redeia achieved a profit of €690 million in 2023. This figure represents an increase of 3.7% compared to 2022, exceeding the company's forecasts.

Revenues (turnover and the share in profits of companies valued by the equity method) grew by 3.1% to €2,129.2 million. These figures reflect an increase in all business activities of the Company, with the most notable growth in the diversified businesses.

Specifically, the management and operation of electricity infrastructure closed 2023 with revenues of more than €1,625 million, a growth of 1.6% year-on-year. Higher revenues from the electricity transmission activity, with a growth of €16.2 million, and from system operation, which contributed €8.7 million more than in 2022, have led to this increase in Red Eléctrica's revenues.

On the other hand, noteworthy are the good results of the international subsidiary Redinter. The Company’s electricity transmission activity abroad has brought the group revenues, including the results of investee companies, amounting to €135.7 million in 2023, up 14.8% on that recorded at the end of 2022. This was due to the commissioning of Tesur 4 in Peru, the second phase of Redenor, which strengthens the electricity connection in northern Chile, and the new assets associated with the activity of the Company in Brazil.

For its part, Hispasat has seen its revenues improve by 9.1% year-on-year, reaching €249.3 million in 2023. This increase in the satellite business is explained by the contribution of the Amazonas Nexus satellite, which began its commercial operation in July and generated €22 million, and by the revenues from Axess Networks, acquired in 2022 as part of the investment plan for the satellite business.

In the case of the fibre optic business, Reintel also increased its revenues by 5.2% compared to 2022.

Gross operating profit (EBITDA) totalled €1,507.8 million, 1.1% higher than in 2022. The international business made a particular contribution to this figure, with EBITDA 16% higher than in the previous year. Net operating profit (EBIT) exceeded €989 million, a rise of nearly 3 percentage points year-on-year.

Net financial debt stood at €4,975.4 million at the end of the year. Concerning its financial structure, the company maintains a solid liquidity position, with a diversified debt in terms of financing sources and a credit rating of A- from S&P and Fitch.

Regarding the dividend, the Board of Directors will propose to the General Shareholders’ Meeting the distribution of a dividend of 1 euro to be charged to 2023 results. From this amount, the interim dividend of 0.2727 euros per share paid on 5 January must be deducted. The final dividend of 0.7273 euros is expected to be paid out in July.

A benchmark in green financing and sustainability

In line with Redeia's commitment to sustainability, the Company continues to make efforts to advance in green financing. By the end of 2023, the group's financing linked to ethical, social and environmental criteria already stood at 59%, up from 42% at the close of 2022. The Company has set the target that, by 2030, 100% of its financial debt will be contracted in accordance with ESG criteria. In this regard, noteworthy was the issue of the green hybrid bond for an amount of €500 million in January 2023 and the issuance of an additional €500 million in green bonds in January of this year.

In 2023, Redeia once again reaffirmed its position as one of the world's most sustainable companies, renewing its inclusion in the Dow Jones Sustainability Index for yet another year. To further strengthen its sustainable leadership, Redeia has deployed its Comprehensive Impact Strategy, with which it will multiply its social and environmental contribution throughout the group's geography and business areas. This strategy, which aims to generate positive impact beyond its investment projects, has led to a significant cultural change in the Company's governance.

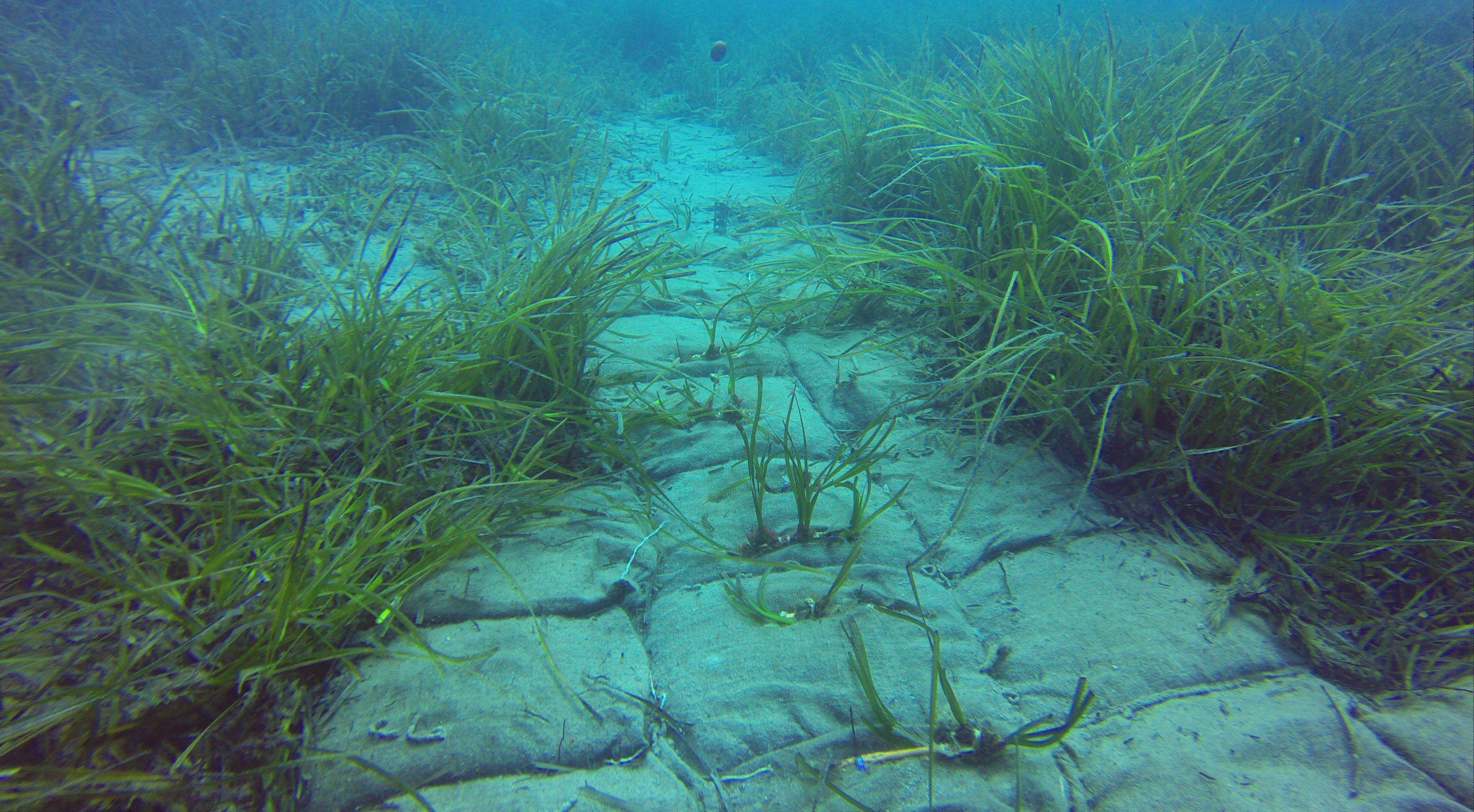

In addition, among the Company's positive impact initiatives, in 2023 the Redeia Marine Forest received recognition with the Renewables Grid Initiative award as the best European practice in electricity transmission grids in the last decade.